Nigerian 'Missing' N275 Billion of Customs' Revenue

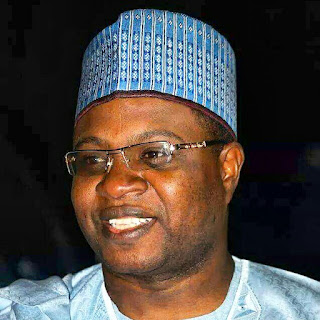

At a recent public hearing, the Accountant General of the Federation, Alhaji Ibrahim Dankwambo told the House of Representatives' Committee on Customs that his office could locate a total of 275,340,998,544 naira of the revenue due to the Nigeria Customs Service, NCS in banks designated to collect such money and remit to a Central Bank of Nigeria (CBN) account maintained for that purpose.

Alhaji Dankwanbo told the committee that 274,799,000,026 naira that should be part of what accrued to the NCS in 2005, and 541,998,518 naira in 2007, were allegedly transferred by the banks to 'unknown accounts'. Debating the AGF's report on the matter, the House Committee alleged that there was 'secrecy' in the procedure in operating the Customs' CBN accounts that is kept by the Accountant General. The committee concluded that the AGF's report indicated 'clearly how the process is anything but transparent; the delay in remittances by designated banks into the CBN pool accounts had been quite alarming in view of the propensity of some of the banks to divert such funds for their own transactions.' Describing the alleged practice as 'criminal' and a breach of the agreements between the banks in question and the NCS, the committees asked that a list of the defaulting banks be sent to it for further investigation within one month.

The fact that such a huge part of government revenue would be 'missing' from the vaults of designated banks is anomalous; that the practice dates back to 2005 without anything being done until the National Assembly intervened, is scandalous. The banks are as complicit in this regard as is the Office of the Accountant General of the Federation. What kind of arrangement did the AGF's office put in place with the banks that could allow their keeping government revenue for so long, and then to later be declared 'missing'?

We agree with the committee's judgement that the banks' conduct, with the complicity of the AGF's office, is criminal. It is obvious from what has transpired that they there has been laxity in the administration of the pool accounts; whether this was the fault of the rules, or the deliberate actions of officials of all the organisations involved, that is the AGF, the NCS and the banks concerned, is a matter that should occupy the scrutiny of the legislators.

The report also revealed that there is poor management of government revenue collection system in the Customs, and probably in other government departments as well, such as the Nigerian Ports Authority (NPA), the Abuja Geographic Information Service (AGIS), the Nigeria Immigration Service (NIS), etc.

Relevant Links

The House committee should go a step further to hold a public hearing on the terms of the current arrangement with the banks on the operation of pool accounts. This should be with a view to re-examining such an arrangement where deficiencies that allow the banks such unfettered leeway with government funds are cured.

In this particular instance, it is necessary to hold to account all the banks involved in the matter. The committee should investigate where the entire money is, into whose accounts the money was paid, and who the beneficiaries of this obviously illegal transaction are.

This single episode also shows how tightening of the revenue collection process of the government can enhance its revenue. While government funds are hanging in various banks, presumed 'missing' by those who should know better, the citizens are the ones that government turns to for taxes to make up for shortfalls in revenue that is already within its grasp. The taxpayer should not be surcharged by government for the incompetence, even fraudulent conduct, of its officials.

Alhaji Dankwanbo told the committee that 274,799,000,026 naira that should be part of what accrued to the NCS in 2005, and 541,998,518 naira in 2007, were allegedly transferred by the banks to 'unknown accounts'. Debating the AGF's report on the matter, the House Committee alleged that there was 'secrecy' in the procedure in operating the Customs' CBN accounts that is kept by the Accountant General. The committee concluded that the AGF's report indicated 'clearly how the process is anything but transparent; the delay in remittances by designated banks into the CBN pool accounts had been quite alarming in view of the propensity of some of the banks to divert such funds for their own transactions.' Describing the alleged practice as 'criminal' and a breach of the agreements between the banks in question and the NCS, the committees asked that a list of the defaulting banks be sent to it for further investigation within one month.

The fact that such a huge part of government revenue would be 'missing' from the vaults of designated banks is anomalous; that the practice dates back to 2005 without anything being done until the National Assembly intervened, is scandalous. The banks are as complicit in this regard as is the Office of the Accountant General of the Federation. What kind of arrangement did the AGF's office put in place with the banks that could allow their keeping government revenue for so long, and then to later be declared 'missing'?

We agree with the committee's judgement that the banks' conduct, with the complicity of the AGF's office, is criminal. It is obvious from what has transpired that they there has been laxity in the administration of the pool accounts; whether this was the fault of the rules, or the deliberate actions of officials of all the organisations involved, that is the AGF, the NCS and the banks concerned, is a matter that should occupy the scrutiny of the legislators.

The report also revealed that there is poor management of government revenue collection system in the Customs, and probably in other government departments as well, such as the Nigerian Ports Authority (NPA), the Abuja Geographic Information Service (AGIS), the Nigeria Immigration Service (NIS), etc.

Relevant Links

The House committee should go a step further to hold a public hearing on the terms of the current arrangement with the banks on the operation of pool accounts. This should be with a view to re-examining such an arrangement where deficiencies that allow the banks such unfettered leeway with government funds are cured.

In this particular instance, it is necessary to hold to account all the banks involved in the matter. The committee should investigate where the entire money is, into whose accounts the money was paid, and who the beneficiaries of this obviously illegal transaction are.

This single episode also shows how tightening of the revenue collection process of the government can enhance its revenue. While government funds are hanging in various banks, presumed 'missing' by those who should know better, the citizens are the ones that government turns to for taxes to make up for shortfalls in revenue that is already within its grasp. The taxpayer should not be surcharged by government for the incompetence, even fraudulent conduct, of its officials.

Comments

Post a Comment